107

TOMORROW

The transition to LNG is no easy

task; however, its implementation

is facilitated not only by Carnival

Corporation’s commitment to move

to clean fuel but also by recent

improvements both in the regulatory

framework and in the availability of gas

bunkering infrastructure. Because of

the new regulations recently adopted

by IMO (International Maritime

Organization), there is a greater push

in the industry today to build ships

that can utilize cleaner burning fuel.

Similarly, to comply with the latest

EU directives, from 2020 ships will

be required to use 0.5% low sulfur

fuel in European waters; the new rules

have already led to the development

of programs for the building of

alternative fuel infrastructure ensuring

the availability of LNG throughout

Europe. To this end, Mediterranean

countries will need to bridge the gap

with North Sea ports where there are

already announced and developed

plans for LNG bunkering. Italy is

working on ways of taking advantage

of the related opportunities. The

Gainn Project (backed by

RINA

[Italian

Shipping Register] and the

Italian

Ministry of Transport

) involves the

development of nine pilot projects in

as many ports, with the objective of

pre-empting domestic legislation (due

to enter into force in November 2016)

transposing the 2014/94/EU Directive,

which lays down regulations for the use

of alternative fuels and the building of

an appropriate supply chain for LNG.

Elsewhere, the LNG-bunkering process

in the main cruise markets is proceeding

at differing speeds and unevenly. In

North America, where the process is

just getting started, the building of

LNG-bunkering platforms should be

favored by the plentiful natural gas

reserves in that part of the world,

although it is true to say that the LNG

storage is not always where the cruise

vessels operate. The Asia Pacific is quite

another story, whereas Singapore,

China and South Korea have invested

in developing LNG as a bunker fuel,

sulfur emissions regulations are only

enforced in a few major ports and

rivers like Honk Kong, Peral River Delta,

Yangtze River Delta and the Bohai Sea.

As a result, demand for LNG will likely

struggle to get off the ground until

stricter regulatory parameters – in line

with those in Europe – come into force.

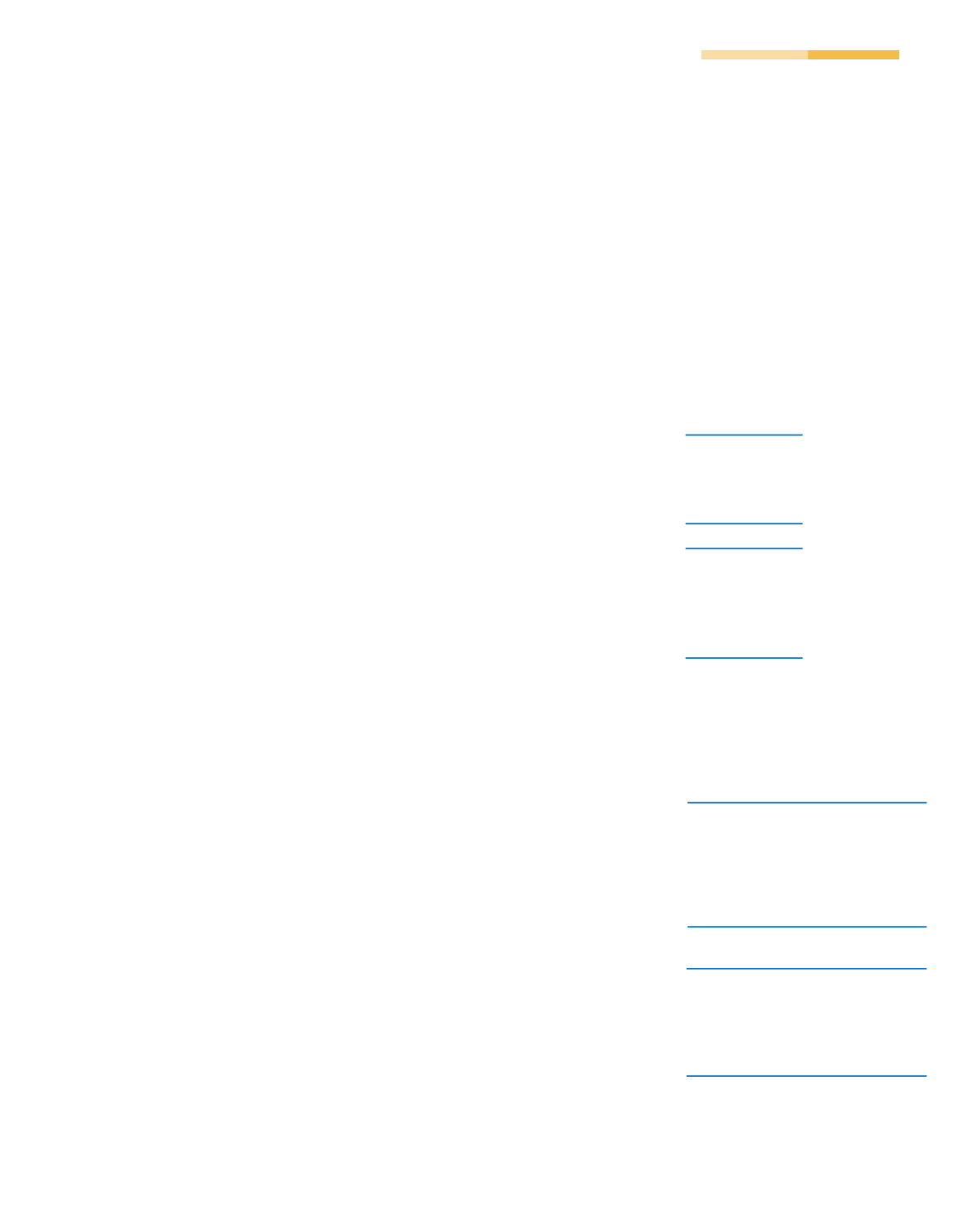

Cruise ships

and impact

Increase

in number

of LNG-powered

ships

PORTION OF GLOBAL CO

2

EMISSIONS CAUSED BY

OCEAN-GOING COMMERCIAL

VESSELS

3% - 4%

CRUISE SHIPS AS A

PROPORTION OF THE

GLOBAL MARITIME FLEET

0.6%

MARCH 2015

59

SHIPS

FORECAST FOR

2020

1,000

SHIPS*

* Source DNV.