ECONOMIC PERFORMANCE

AND INVESTMENTS

The Costa Crociere Group performed well in fiscal 2015 and continued to enjoy a

substantial recovery. The Group carried a total of 2.6million guests during the reporting

period, which was substantially in line with the number of passengers carried in

2014; this result was achieved in the context of ongoing economic headwinds and the

consequences of the terrorist attacks in Tunisia and Paris, which negatively impacted

demand in the tourism industry internationally but especially in the Mediterranean.

Operating income was 482 million euros, a slight increase on the previous year (477

million euros)

2

. If we leave to one side the impact of extraordinary operations, the

increase in profit in 2015 amounts to 32 million euros in absolute terms, up 6.3%

on the previous year. This positive result was accomplished partly on account of the

growth in revenues (+86 million euros), driven by the increase in passenger capacity

following the entry into service of the ship Costa Diadema at the end of 2014, and

also thanks to energy-saving efforts with a range of initiatives and actions aimed at the

monitoring and reduction of fuel consumption, fuel being one of Costa’s major cost

items. In 2015 the average cost per metric ton fell by 25.6%, enabling a saving in the

income statement.

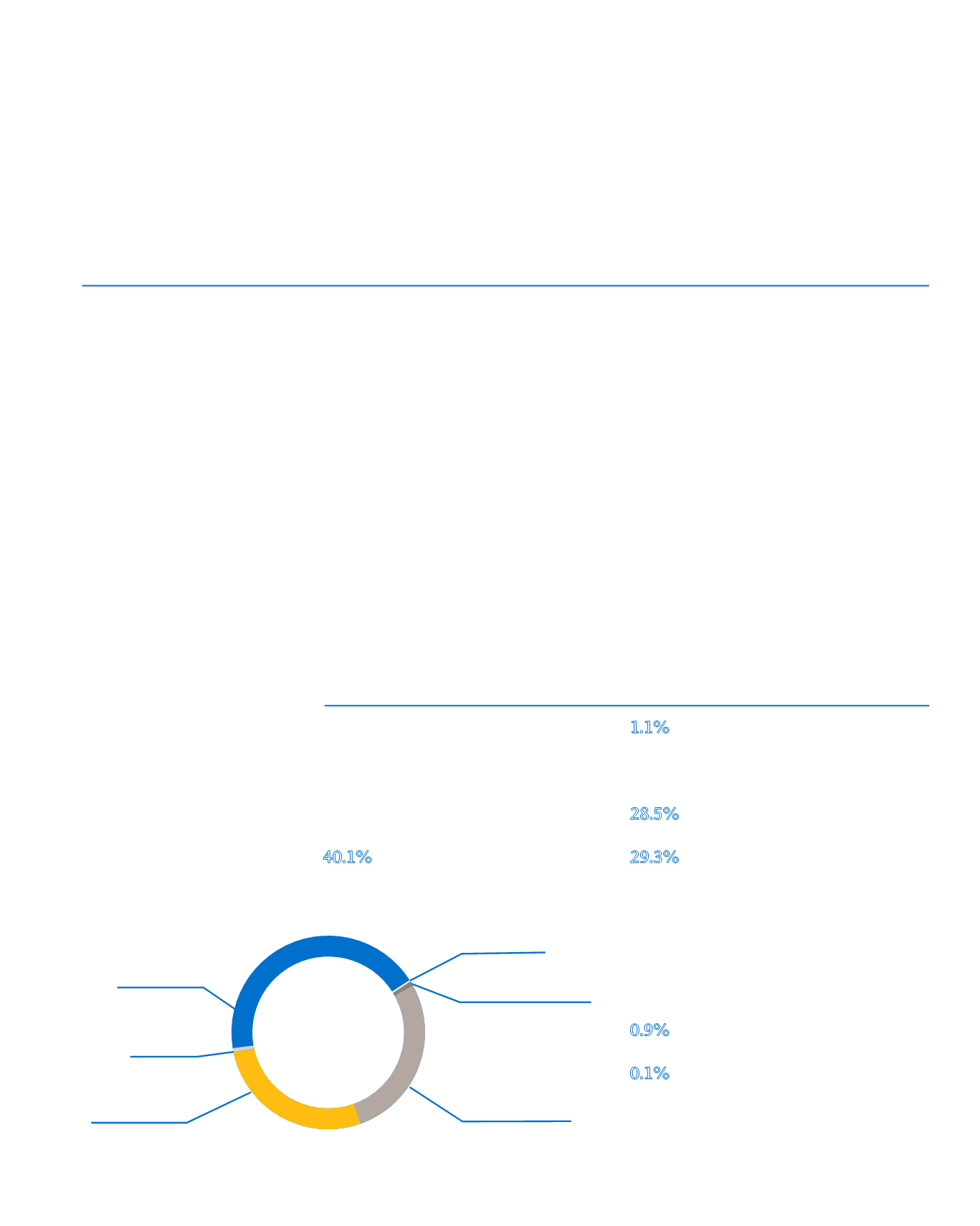

Added Value

1.1%

for the State and Public

Administrations in the form of

income tax paid by Group

companies

28.5%

for shareholders in the form of

dividends

29.3%

for Company growth by means of

reinvestment of a portion of net

income (including 2.3% set

aside for the Legal Reserve

and 27% for depreciation of

technical and intangible fixed

assets used in the production

process)

0.9%

for lenders remunerated by

means of financial charges

0.1%

for the community by means of

initiatives in support of

organizations and associations

The net Added Value

3

distributed in 2015

amounted to 1,377 million euros, a year-

on-year increase due both to the higher

revenue from cruise sales and to the

lower intermediate production costs; the

breakdown is as follows:

40.1%

for employees’ salaries, wages

and social contributions

2

The 2014 figure was impacted by

extraordinary impairments to the

tune of 26 million euros following the

termination of the charter contracts for the

Iberocruceros brand ships, while operating

income in 2015 includes depreciation for

the amount of 53 million euros for the

writedown of the ship Costa neoRiviera

following an impairment test carried out at

the end of the fiscal year.

3

Added Value was calculated for the Costa

Crociere Group using the continuing

operation principle.

0.1%

40.1%

EMPLOYEES’

WAGES ETC

COMMUNITY

28.5%

SHAREHOLDERS’

DIVIDENDS

0.9%

LENDERS

1.1%

PUBLIC

ADMINISTRATION

ALLOCATION

OF

ADDED VALUE

29.3%

REINVESTMENT